Savings bonds calculator series ee

EE bonds bought from May 1997 through April 2005 earn a rate of interest that changes every six months a variable rate. Using EE Bonds for Education.

A Complete Guide To Investing In Tips And I Bonds 2022 Money For The Rest Of Us

EE bonds are one of the lowest-risk investment choices out there Pendergast says.

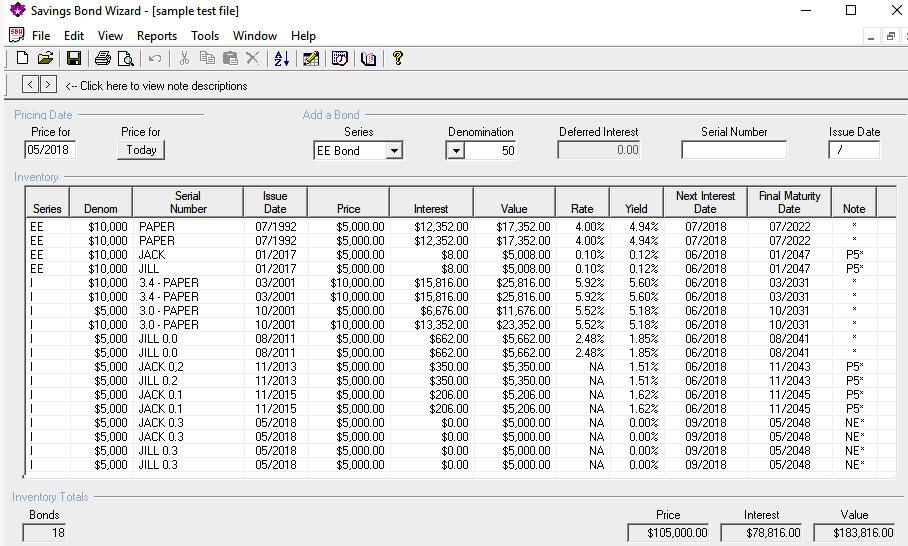

. Other features include current interest rate next accrual date final maturity date and year-to-date interest earned. Interest rates for Series EE. Series EE savings bonds have a fixed interest rate Series EE bonds issued before May 2005 may have a variable rate.

Therefore if you want a Series EE savings bond youll need to. Any federal estate gift and excise taxes as well as any state estate or inheritance taxes. Treasury Department completely eliminated paper savings bonds in an effort to save on paper and manufacturing costs.

A series EE savings bond is a savings product issued by the US. Series EE Savings Bonds. This Calculator provides values for paper savings bonds of these series.

For an EE bond bought from May 2022 through October 2022 the rate is 010. There are a few types of bonds you may have. Each person may invest in up to 10000 of Series EE or Series I bonds.

Regardless of whether its a paper or electronic bond you can actually cash in savings bonds as soon as 12 months from the date they were issued. Starting with a 25 bond you can buy up to 10000 per year online at TreasuryDirectgov. Government that pays interest for a maximum of 30 years.

Otherwise you can keep savings bonds until they fully mature which is generally 30 years. A series EEE bond earns a fixed rate of interest for up to 30 years. Series EE Series I.

The Calculator will price paper bonds of these series. You can decide whether these bonds make sense for your portfolio when you understand how long it takes Series EE savings bonds to mature. Learn more on Interest Rates Current and Past.

EE bonds issued in May 2005 and after earn a fixed rate of return. EE E I and savings notes. Interest gets added to the bond monthly and the government guarantees that the bond will double in value after 20 years.

This should load the file into your web browser where you can click the Return to Savings Bond Calculator button to update the values. The bond isnt worth its face value until it matures. Accrual-type security with a fixed interest rate.

Comparing I Bonds to EE Bonds. Find the value of your savings bonds Calculator. After 30 years.

The interest that your savings bonds earn is subject to. The two types or series of savings bonds are mostly similar but differ in a few key ways. Bonds purchased between May 1997 and April 30 2005 earn a variable market-based rate of return.

Series EE bonds are a type of low-risk US. When you buy the bond you know the rate of interest it will earn. The annual purchase limit for Series I savings bonds in TreasuryDirect is 10000.

Cash paper savings bond. These days you can only purchase electronic bonds but you can still cash in paper bonds. Treasury with a 30-year term they are an.

Accrual-type security which combines both a fixed interest rate. As of the beginning of 2012 the US. EE bonds issued since May 2005 earn a fixed rate of interest.

Were older EE bonds different. Using the money for higher education may keep you from paying federal income tax on your savings bond interest. Series EEE Series I or Series HHH.

Gift purchases are attributed to the recipient. Broadly diversified blue-chip stocks that earn 3 to 4 returns might be one option. EE bonds issued from May 1997 through April 2005.

SeriesThe series can be found in the upper right corner of your paper savings bond. EE bonds bought before May 1997 earn interest at different rates depending on when they were bought. For example if you own a 50 bond you paid 25 for it.

The Calculator can show what your paper bonds are worth in any month from January 1996 through the current rate period. How Treasury auctions work. Alternatives to Series EE Bonds.

Savings bond that are guaranteed to double in value after 20 years. Treasury Hunt Securities we sell. You might be wondering when you can redeem Series EE savings bonds.

Compare different series of savings bonds. How to buy Series EE. Whether Series EE Savings bonds make good investments depends on your individual circumstances and goals.

Series EE Bonds dated May 2005 and after earn a fixed rate of interest. Because they are issued by the US. You can choose another option if savings bonds arent the right fit for you.

EE Bonds are no longer sold as paper bonds and earn interest at a fixed rate since 2005. Federal income tax but not to state or local income tax. I Bonds are only available for purchase as paper bonds with your IRS tax refund.

Paper Series EE bonds were sold at half their face value.

167 Treasury Bonds Stock Photos Pictures Royalty Free Images Istock

How To Calculate Bond Value 6 Steps With Pictures Wikihow

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

167 Treasury Bonds Stock Photos Pictures Royalty Free Images Istock

/savings-bonds-vs-cds-which-better-2016.asp_V1-4754e38f62f64fc7bb19a06de61c8817.png)

U S Savings Bonds Vs Cds What S The Difference

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Savings Bond Hi Res Stock Photography And Images Alamy

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha

How To Calculate Bond Value 6 Steps With Pictures Wikihow

How To Calculate Bond Value 6 Steps With Pictures Wikihow

How To Find A Lost Savings Bond Bankrate

Savings Bond Hi Res Stock Photography And Images Alamy

How To Calculate Savings Bond Interest 14 Steps With Pictures

How To Calculate Bond Value 6 Steps With Pictures Wikihow

How To Calculate Bond Value 6 Steps With Pictures Wikihow

:max_bytes(150000):strip_icc()/close-up-of-multiple-savings-bonds-1059310052-7a0dd99c399b45f0bc0e91ae253f1423.jpg)

I Bond What It Is How It Works Where To Buy

How Do I Calculate The Value Of Paper Savings Bonds